M&A Advisory

AWR Lloyd provides a full concept-to-completion M&A advisory service as well as transaction management services and specific deal support services.

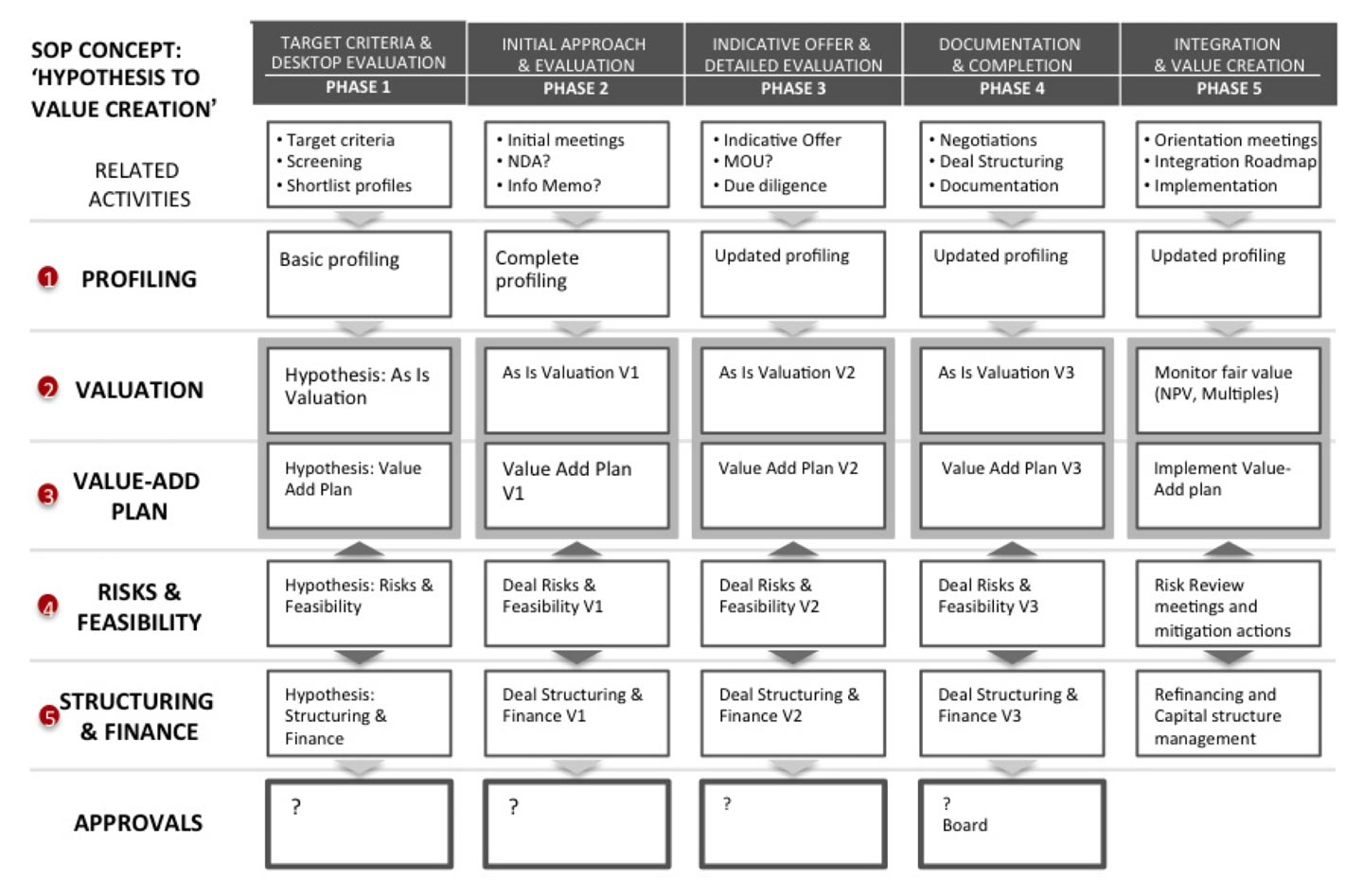

For buy-side clients, full service approach is split into five phases:

- Phase I: Target Criteria & Desktop Evaluation

- Phase II: Initial Approach & Evaluation

- Phase III: Indicative Offer & Detailed Evaluation

- Phase IV: Documentation & Completion

- Phase V: Integration & Value Creation

Throughout these five phases, there are always six parallel themes which form the focus of our activity and analysis:

- Profiling: profiling the companies, assets and investors involved

- Valuation: of targets on an ‘as is’ basis under existing management

- Value Creation Plan: how the acquirer intends to add value to the assets post-acquisition or how the merger will generate value

- Risks & Feasibility: the feasibility of the transaction and the risks of the transaction and assets involved

- Structuring & Finance: structuring the transaction and financing it

- Approvals: obtaining the necessary investment committee, board, shareholder and regulatory approvals at each stage

In the first phase, AWR Lloyd works with the client to set basic target criteria, identify the universe of targets, screen targets, short-list targets and conduct desktop profiles based on publicly available information and AWR Lloyd’s in-house industry databases. The profiling is a basic assessment of target background, shareholders, operations, output, reserves and resources, customers, markets, financial structure and senior management. Valuation is based on simple NPV and multiples valuation analysis. The value creation hypothesis is formed in a preliminary way and basic deal risks and feasibility issues are raised. Tactics for approaching shareholders or management are discussed and agreed.

In the second phase, AWR Lloyd assists in arranging initial meetings with target sponsors, expressions of interest, exchange of confidentiality agreements and receipt of any information packs (e.g. information memorandum). The profiling of the target at this stage will include background analysis, shareholder structure, corporate structure, operations, technology, products, supply sources, customers, markets, pricing, HSE, legal, regulatory, management and financial evaluation. The valuation analysis becomes a more fully worked and detailed discounted cash flow analysis. The value creation plan is tested and formulated in more depth. Risks and deal feasibility are also assessed more accurately.

In the third phase, AWR Lloyd assists with drafting indicative offers and/or MOUs. We also assist with the co-ordination of due diligence (operational, technical, commercial, legal, regulatory and financial) and help with summary write-ups of the main reports by engineers, accounting advisors and lawyers. We base our analysis on data room information, management presentations, detailed Q&A and site visits. We develop our valuation analysis further and assess risks in more depth. We focus as much as we can on testing the value creation hypothesis and helping the client to develop a post-transaction plan. We help the client to develop a financing plan for the transaction (with internally generated cash, debt and/or shares) – and begin to refine the potential deal structure.

In the fourth phase, AWR Lloyd is focused on negotiations and deal structuring. We assist with deal documentation (sale and purchase agreements, reps and warranties, conditions precedent…) in conjunction with lawyers and help to analyze any remaining due diligence and risk issues.

The value creation plan by this stage must become specific and detailed, for example including a clear integration and post-deal HR plan. AWR Lloyd will advise the client throughout the process until completion, signature and execution. In many cases we can also then assist in communication of the transaction to regulatory authorities and to the investment community (via press releases and special analyst meetings).

In the fifth, AWR Lloyd can help its clients with the implementation of its value creation plan. We can assist with orientation meetings, the further development of an integration roadmap and advise on aspects of the execution of the plan. We can help monitor value creation and prepare and support risk review meetings and mitigation plans. Finally, we can advise our clients on any financial planning, refinancing or investor communication relating to the post-deal phase.